“In 2021, as AP leaders navigate the current state of business, a majority (60%) still face lengthy invoice payment and approval times. While this has always been a ‘top five’ issue for AP groups, this is the first time in many years that approval process deficiencies rank as the absolute top challenge.”

In earlier blogs, we discussed how eProcurement technology is the essential building block of effective supply chain management, and how automating invoice processing can lead to cost reductions, greater efficiency, and an improved bottom line. Today, we’ll focus on how modernizing your payment solution can reduce time spent paying invoices, and turn your AP department into a net revenue generator.

Payments

According to the Institute of Finance & Management (IOFM), AP staffers spend 84% of their time processing invoices[i]. Hospitality AP professionals are quickly realizing that success going forward will need to involve technological transformation.

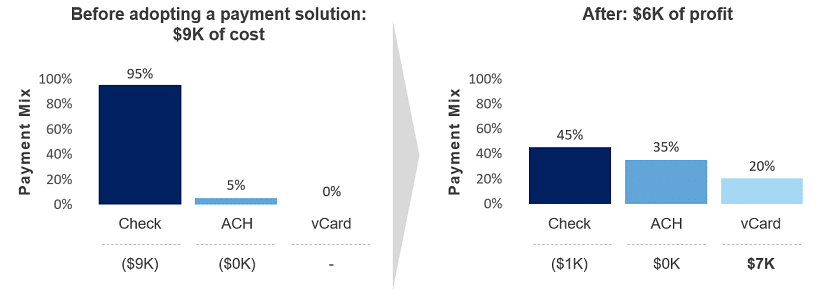

Modernizing your payment solution can help. Let’s take a look at one client’s story: Prior to modernizing their payment solution, this client was paying 95% of their invoices by check, 5% via ACH and had no vCard payments in place. Their manual processes meant invoice approvals were taking up to 10 days. After adopting an automated invoice management solution, the hotel was able to shrink approval time to 3 days, as well as reduce checks by 50%, increase ACH by 30%, and add in vCard as a payment option. By updating their solution, the hotel went from a cost of $9K for processing to a profit of $6K, and improved their relationships with suppliers by expediting payments.

As you can see, modernizing your payment solution offers a number of benefits:

- Reduced Costs: A vendor enablement team will shift payments away from costly paper checks to low-cost ACH or no-cost vCard. Further adding to the value, with staff reduced at many hotel management companies and resources needed to be reallocated to other activities, the payment process is as easy as pushing the payment file into the system: no check printing, envelope stuffing, or postage

- Increased Revenue: Best-in-class solutions are generally able to convert 20% of vendor spend to vCard. As a consequence, vendors get a more secure, consistent, and convenient form of payment in exchange for paying interchange fees, and a portion of those interchange fees are rebated back to the buyer, generating a new revenue

Insight: Modernizing your payments as part of automating the P2P cycle, and aligning to industry best practice, has a clear and compelling ROI. Between the reduction in direct cost and the ability to redeploy resources to more strategic initiatives, the case for back-office automation in hospitality has never been stronger.