As of late May, nascent recoveries underway in China, Germany, and in certain US drive-to markets have revealed definitive patterns: economy travel will recover more quickly than upscale, travelers will skew younger and will gravitate toward domestic drive-to markets, and destinations with outdoor and nature-related attractions will initially see the strongest demand. Additionally, in conversations with our customers in the managed food service, gaming, and hotel management space, a consensus has formed as to the sequence by which traveler segments are expected to return:

- Domestic drive-to leisure

- Distance leisure

- Business

- Group events/conferences

While understanding these high-level trends is useful, the above information doesn’t exactly help operators solve dilemmas related to reopening. In this post we will focus on one deceptively simple question: where should management companies be spending their money? With that question in mind, we have analyzed BirchStreet global category spend across six continents, across hotel scales from economy to luxury, and across marketplaces with and without GPO suppliers for the periods of January to April 2019 and January to April 2019. This analysis has yielded what we and our partners consider to be key insights into three critical categories of spend: F&B, CapEx, and IT. We hope our findings will help you spend wisely and accelerate your return to profitability.

Global Food & Beverage Spend for Jan 2020-Apr 2020: Down 93%

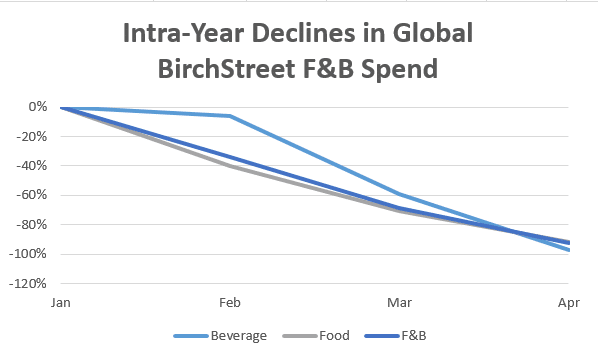

BirchStreet F&B spend globally cratered in April, down 93% intra-year from a high in January. While beverage spend initially showed more resilience than food spend, down just 6% in February compared with food’s 40%, beverage ultimately fell further, down 97% versus food’s 92% in April.

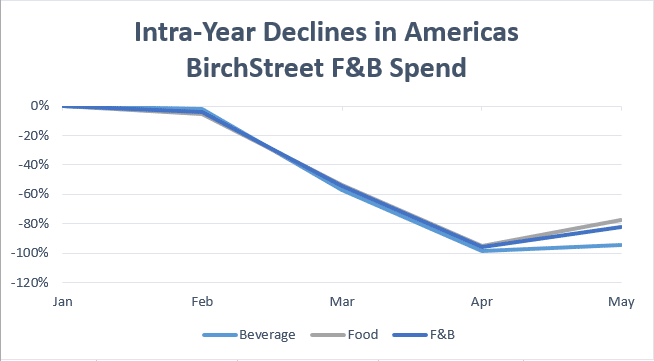

Fortunately, preliminary May 2020 for the Americas shows a decided uptick in F&B spend in May, up 14% percentage points from April relative to January’s high. Food appears to be leading beverage in the recovery, perhaps indicating efforts to restock perishable items in advance of increased demand.

Beyond these sobering numbers, some interesting trends have emerged, particularly as it relates to spend concentration and the culling of SKUs. One leading managed food service company that operates F&B-centric venues such as stadiums, parks, and conference centers, told the BirchStreet Customer Advisory Board that as of May, they are no longer carrying 60% of the SKU’s they were carrying in March. This hyper-focused approach to purchasing in the face of uncertain demand accomplishes several goals:

- First, by reducing the number of SKU’s and menu offerings, the company simplified and streamlined the ingredient prep and cooking process, thereby saving the reduced culinary teams valuable time.

- Second, by focusing on SKU’s that were largely non-perishable, relatively inexpensive, and historically had high consumption rates, they were able to prevent food waste before it happened and concentrate on higher-margin menus.

- Finally, by funneling more volume through core SKU’s, they were able to strengthen supplier relationships and negotiate more favorable payment terms.

Because this customer maintained a strict global Item Master within BirchStreet, they were able to quickly consolidate vendors from their central procurement team and push the changes out to their distributed locations, rapidly modifying their spend profile, reducing risk, and lowering costs.

Insight #1: Consider greatly reducing SKUs for F&B items to control costs, improve operational efficiencies, and enhance margins during re-opening.

Global CapEx Spend for Jan 2020-Apr 2020: Down 46%

Down 46% YTD, CapEx was one of the least impacted categories of BirchStreet spend. Those businesses with strong balance sheets are using this ‘pause’ in hospitality travel to focus attention on hotel maintenance and renovations. Improvements are being further influenced by Covid-19, especially in areas where an investment today can have an immediate impact on employee and guest safety.

Indeed, new regulations and concerns around hygiene have forced companies to rework their interiors on the fly: decorative pillows, bed scarves, and other absorptive items are out, as are communal tables, benches, and other design elements meant to foster interpersonal interaction. Easy to clean and disinfect furniture, fixtures, and equipment are high up on procurement team’s lists to source, while at the same time maintaining appropriate design characteristics to fit in with the aesthetics of the property.

Additionally, new categories of spend, like Plexiglas, sneeze-guards, and hard-surface dividers have seen surges in demand. “Transparency and tangible (hygiene) cues will give consumers more comfort,” said Donna Quadri-Felitti, director of the hospitality management school at Pennsylvania State

University. Additionally, outdoor social and dining spaces have taken on new importance and require new capital investments to ensure health and safety measures, while enticing guests back through the doors. Now more than ever, those hotels and restaurants with large indoor and outdoor ‘footprints’ may be in higher demand.

Mr. Russell Kett, Chairman of HVS London comments “Building trust between hotelier and customer will be paramount, with businesses operating and presenting their services in a way that makes the guest, and the staff who take care of them, feel comfortable, confident and protected.”

Insight #2: Spending capital wisely is now more important than ever before. Hotel operations teams need to work closely with finance, owners, and their suppliers to modify properties with appropriate FF&E, while minimizing costly mistakes by limiting unnecessary, perhaps ‘non-returnable’ purchases.

Global IT Spend for Jan 2020-Apr 2020: Down 8%

Down just 8% YTD, IT is by far the least impacted category of BirchStreet spend. Leading brands and management companies have accelerated their digital transformation in the face of COVID, investing not only in the hardware necessary to enable remote working like laptops and monitors, but also in new software systems that will allow them to streamline processes, go touchless, and, ultimately, increase profitability.

One company that is focused on technology innovation in both the front- and back-of-house is Hilton. Hilton has been delivering lead-edge, cloud and app-based technologies for years, from their digital key allowing touchless check-in and check-out for guests, to their Hilton Honor’s App which will form the foundation of their strategy to tempt guests back, in a safe and indeed hospitable way. In a recent Skift interview, Chris Nassetta, CEO of Hilton, said “The core elements of our business…(are not) going to change. Certain mechanical elements of the experience are going to be digitized, but that was happening anyway. It’ll just happen faster.”

Insight #3: Now is the time to thoroughly analyze how investing in proper technology and changing outdated processes and procedures can return your business to profitability faster.

As the data shows, leading hotel management companies are focused on managing their F&B SKUs, investing in appropriate capital improvements, and doubling down on IT, technology, and automation. These areas are undoubtedly going to lead much of the return to profitability. In our next post, we will look deeper into those back-office initiatives that are most important to pursue, and will drive the greatest return to your employees, your guests, and to your owners.